Committed to Helping Investors Increase Profits and Reduce Risk

Dedicated to bringing sophisticated analysis of the stock market to the average investor, InvesTech Research began national circulation of its market letter in December 1982. Today, the InvesTech Research newsletter has earned widespread recognition for its time-proven risk allocation strategy, as well as in-depth analysis of the Federal Reserve. From its unique blending of monetary and technical analysis to sector and asset allocation recommendations, InvesTech presents unbiased advice and a valuable perspective.

Insights That Stand the Test of Time

InvesTech maintains over 120 years of financial and historical market data, and has proven to be remarkably accurate at assessing market risk and advising subscribers when to be most bullish and when to be more cautious.

Your Guide to “Safety-First” Profits

InvesTech earned widespread recognition as one of only a handful of research services to warn of imminent danger prior to Black Monday on October 19, 1987. In 1991 InvesTech published its “TORO… TORO…” issue, just 10 days before the January stock market blast-off. And during the late 1990s, InvesTech consistently cautioned investors about the dangers of the speculative bubble gripping Wall Street. InvesTech’s safety-first investment philosophy led investors safely through the bear market of 2000-02, plus limited losses to half of the market decline in the 2007-2009 recession. In March 2009, just 4 days after the bear market bottom, InvesTech boldly advised investors that they were “heading toward a buying opportunity of a lifetime!”

This distinctive approach to market analysis has led to InvesTech being frequently quoted in Barron’s, Business Week, Forbes, Money Magazine, Worth, U.S. News & World Report, USA Today, and The Wall Street Journal (visit In The News to read specific articles). In 1996 Mark Hulbert (editor of the Hulbert Financial Digest) recognized InvesTech “as one of only 6 newsletters that have beaten the market on a risk-adjusted basis since inception over 10 years ago.” To experience our time-tested strategy, subscribe today.

InvesTech Research Throughout the Years

The following InvesTech Research newsletters were released during critical turning points in the market. Read the original issues as they were published. Click here to view our full 40+ year Track Record.

From the Desk of Jim Stack

A Philosophy Based on Experience

Founder and President, InvesTech Research

Over the years, at least three doctrines have influenced and created my personal investment philosophy. These carry a heavy weight in all my investment decisions.

My indoctrination into the stock market, or “baptism by fire” as I remember it:

It came during 1973-74 as I watched my own portfolio lose over -50%, the Nasdaq Index lose -60%, and even the stock of my bluest-of-blue chip employer (IBM) drop -58%. I also remember the despair as retirees were forced to cancel or reverse their retirement plans simply because their portfolios had lost too much. I have unending respect for those little “blips” on historical wall charts. They represent real bear markets, with big losses. And believe me, they’re a lot tougher to recoup than the stories portrayed by mutual funds, asset allocators, and the media.

1. Educational and professional background based on logic and reason

With an engineering degree and experience as a Project Manager with IBM Research, my approach to the markets could only be analytical, rather than emotional. That can be a valuable asset in an aging bull market fueled by greed and emotion… or in a bear market seized by panic.

2. Historical knowledge founded on years of research

I know from research that the “correct” decisions on Wall Street invariably require you to move against the crowd… and at times, against every emotional fiber in your body. It was this historical tempering that permitted InvesTech to identify the start of the huge 1991-2000 bull market (our issue titled “TORO! TORO!” was published on January 4, 1991) and propelled us to advise subscribers in March 2009, just 4 days after the bear market bottom, that they were “heading toward a buying opportunity of a lifetime.” Conversely, it is that same tempering that forced us to step aside early, and avoid the Wall Street bubble as it popped in March 2000… devastating the average investor.

3. Our consideration and respect for our subscribers

Surveys show the median age of our subscriber base is 57 years. That means most are in, or within a dozen years of, retirement. It’s not enough for one to ride down a major bear market with a loss of -45%, and feel “good” because the S&P 500 lost -50% or more. In that respect, we are not part of the Wall Street crowd or consensus.

Our goal is not merely to maximize return, but to maximize risk-adjusted-return… or provide the best possible gains for the amount of market risk taken. Our long-term track record, especially during the 1987 Crash, and 2000-02 and 2007-09 Bear Markets, has proven an ability to do just that.

In our ongoing commitment to our subscribers, the staff at InvesTech Research is consistently looking for new tools and models to measure risk and determine when and when not to be an aggressive investor in the stock market. We will always try to improve our investment returns. However, you will never see us sacrifice our objective, safety-first strategy for the sake of a quick profit or the comfort of merely being a part of the crowd.

Sincerely,

James B. Stack

President

Follow InvesTech’s Indicators on a daily basis – easily explained for both seasoned professionals and non-technical investors.

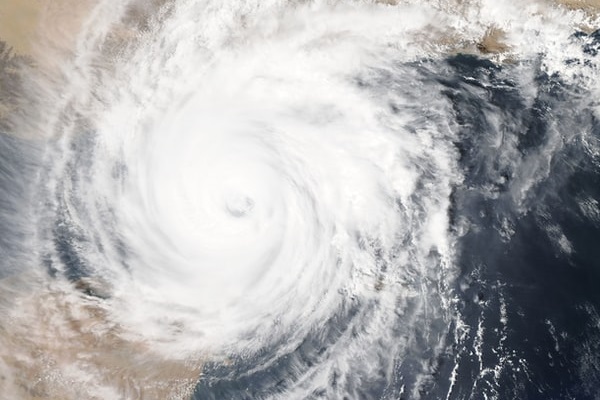

InvesTech utilizes a wide range of indicators to gain insight into the monetary and economic environments, as well as technical factors such as breadth, leadership, momentum, and sentiment. These indicators are useful for determining the amount of potential risk and reward in the market, as well as the likelihood of a bear market rearing its ugly head in the near future.

Stay up-to-date on recent data releases, how you should be investing, and what you should be watching for going forward.

InvesTech’s Market Insights will keep you current on the most recent data releases, new research we have performed, and how this information affects your investing.

Align your investments to our Model Fund Portfolio.

The InvesTech Model Fund Portfolio is designed for individual investors who want to follow our allocation and sector recommendations for the equity portion of their portfolio. Subscribers who follow the Model Fund Portfolio can track the trades we’re making in real-time as we implement our “safety-first” strategy.

Financial Market data at your fingertips.

The InvesTech Daily Data page contains a wide-range of financial market data for subscribers to monitor the market on a day-to-day basis, while also keeping a pulse on some of our most critical indicators.

Kiplinger’s Personal Financial magazine named InvesTech Research the “Best Stock Market Letter” available to investors.

With the InvesTech Research newsletter, you’ll find financial news and analysis prepared to stand alone against the crowd, backed by over 120 years of market data. We help you to recognize and seize low-risk profit opportunities, and shield investment capital during treacherous times.

Curated Articles and Special Reports.

Explore our library of Special Reports that feature the best research from past issues of the InvesTech Research newsletter. These studies were chosen for their insight into important stock market topics of a timeless nature and with strong historical relevance. Learn more about past market cycles, bubbles, and important strategies for long-term investment success.