Read the December Issue of the InvesTech Research Newsletter!

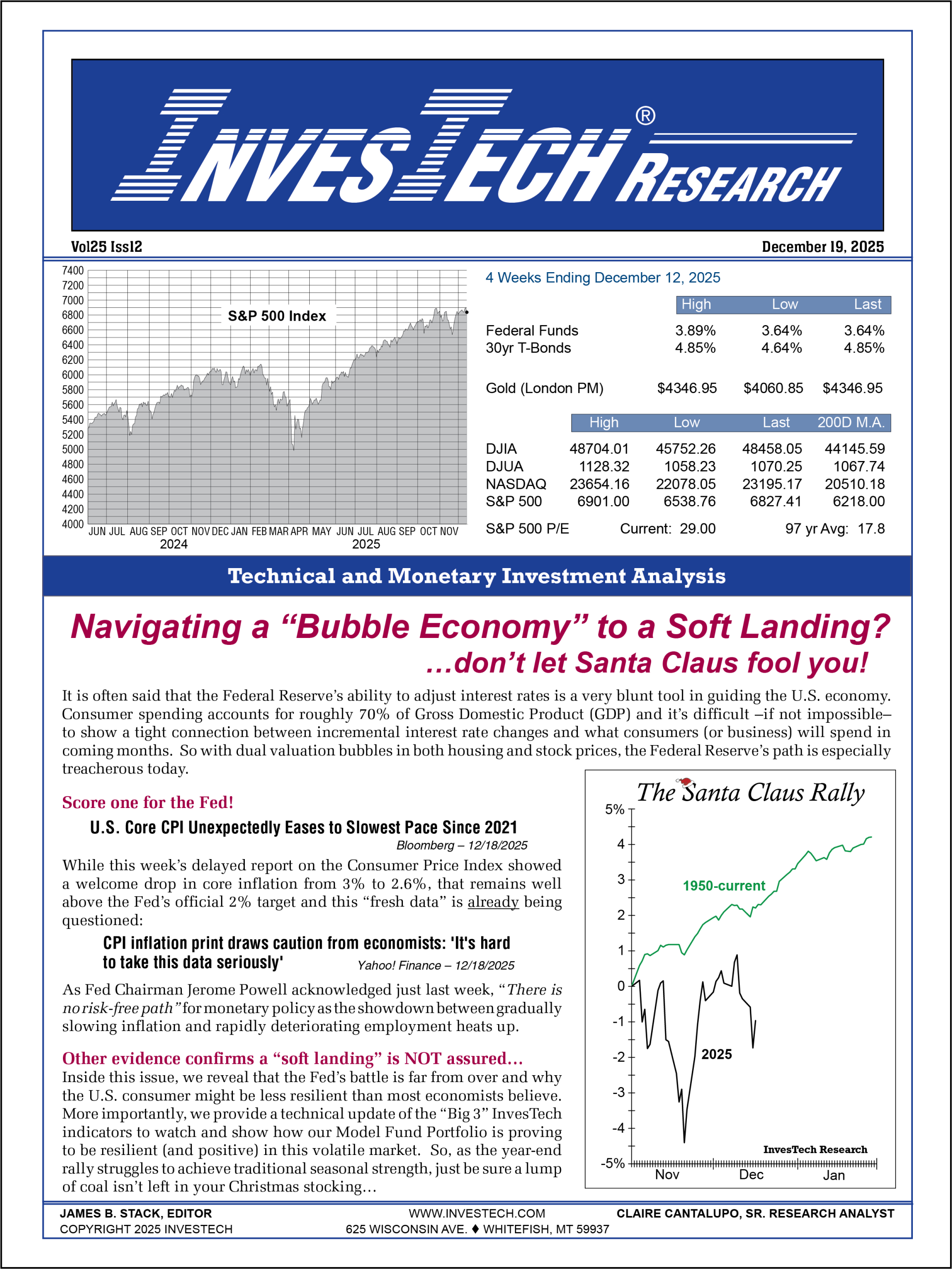

Navigating a “Bubble Economy” to a Soft Landing?

…don’t let Santa Claus fool you!

Most seasoned investors are familiar with the “Santa Claus” rally which historically brings the stock market to a strong finish. This year, however, has us questioning if Santa will really come to town as the S&P 500 sits at a loss for the holiday season.

So, in our latest issue of InvesTech Research:

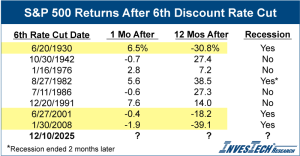

- We reveal how the Fed’s battle is far from over.

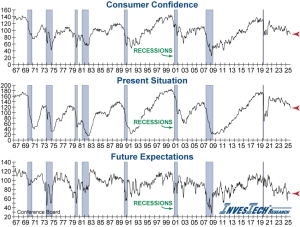

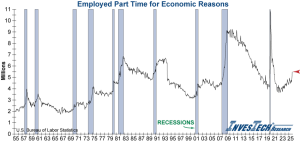

- We expose why the U.S. consumer might be less resilient than most economists believe.

- More importantly, we provide a technical update of the “Big 3” InvesTech indicators to watch going into the new year.

As the year-end rally struggles to achieve traditional seasonal strength, just be sure a lump of coal isn’t left in your Christmas stocking…

Exclusive Subscriber Resources & Tools

InvesTech Issues

The monthly InvesTech Research newsletter contains both monetary and technical analysis and unique research.

Market Insights

Keep up with timely economic news and data releases and how these may affect your investing.

InvesTech Hotlines

Updated each Friday to provide a summary of the week’s important data releases, technical updates, and any changes to the Model Fund Portfolio.

Model Fund Portfolio

View the current investment allocation in our Model Fund Portfolio and access the latest trades as they happen.

InvesTech Indicators

Follow InvesTech’s proprietary technical indicators daily to watch for important breakouts or warning flags.

Daily Data

Daily access to a wide range of stock market metrics, including market indexes, breadth/volume data, and short-term indicators.

Subscriber Survey

You should have received an email from investech@investech.com via SurveyMonkey on Thursday, November 13th – rest assured that’s from us! If you did not receive this subscriber survey and would like to take part, please click here to access it.

We’re excited to hear your thoughts, suggestions, and input as we strive to improve both our InvesTech Research Newsletter and our website. We appreciate your taking the time to share them with us. Remember, you’ll be entered to win one of 5 FREE one-year subscriptions if you complete the survey!

Recent Market Insights

InvesTech Research: A Proven Track Record for Over 40 Years

InvesTech Research offers a unique “safety-first” investing strategy to our readers located throughout the United States and 43 countries around the world. We use proven proprietary models and objective analysis to provide clear, researched market analysis you can rely on.

Kiplinger

Rated Best Source of Investment Advice by Kiplinger Personal Finance Magazine.

Best Stock Market Letter

InvesTech Research, which promises ‘safety-first profits,’ has bested the overall stock market over the long haul with less risk. Publisher James Stack analyzes economic, monetary and market data (some going back more than 100 years) to make market calls and recommend allocations.

InvesTech Research is frequently quoted in the following:

Visit our In The News to read more.