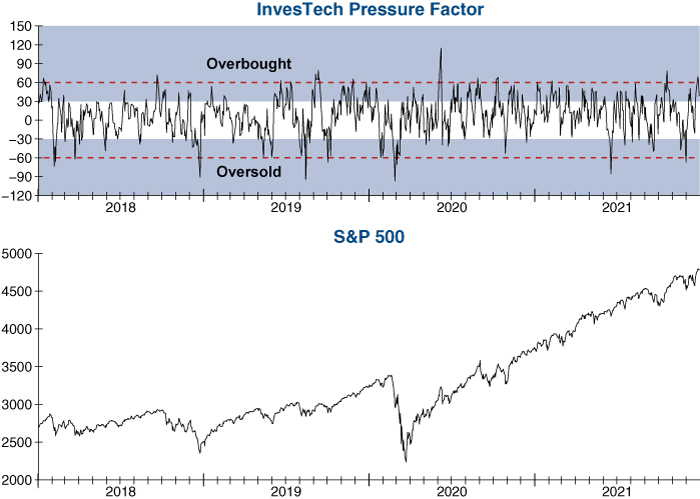

Our InvesTech Pressure Factor, a technical tool that indicates how overbought or oversold the market is in the short term, reached an extreme overbought reading of + 69 earlier this week. It is important to note that the Pressure Factor should not be used as a trigger when it enters the overbought region, but rather when it exits it– which we are seeing today. This extreme reading and subsequent decline is an indication that the market has climbed too far, too fast.

Given the shorter-term nature of this tool, extreme Pressure Factor readings are best used as guides in the tactical decision-making process, and not as long-term buy or sell signals. The S&P 500 Index has traded modestly lower following this week’s extreme Pressure Factor reading. However, the market is not out of the woods yet, as volatility may resurface in the new year after the conclusion of this customarily quiet holiday trading week.