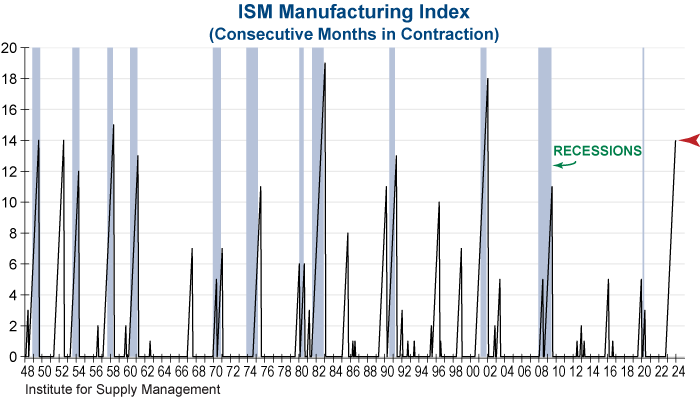

The ISM Manufacturing PMI was released today for December and came in slightly above forecasts, but still in contraction territory (< 50.0). This is its fourteenth consecutive month in contraction. Out of the six largest manufacturing industries, none reported growth in December. The pace of contraction has slowed, but manufacturing is still very much in a recession.

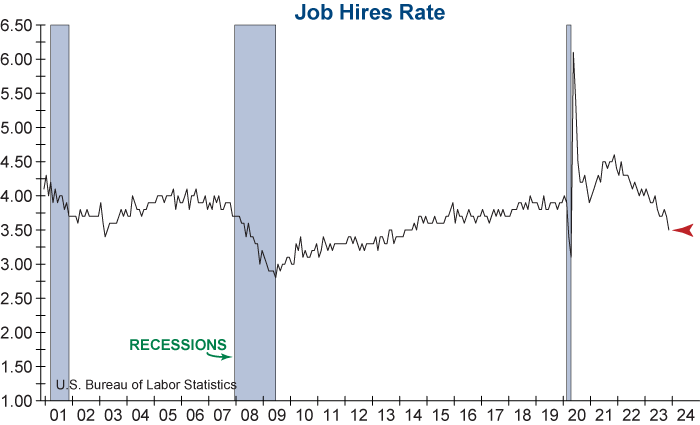

Also released this morning was the Job Openings and Labor Turnover (JOLTS) Report from the Bureau of Labor Statistics for the month of November. The number of job openings fell slightly and was below expectations. Most notably, however, the number of hires dropped, resulting in a significant decrease in the hires rate that is notably lower than its pre-pandemic level and its lowest since 2014.

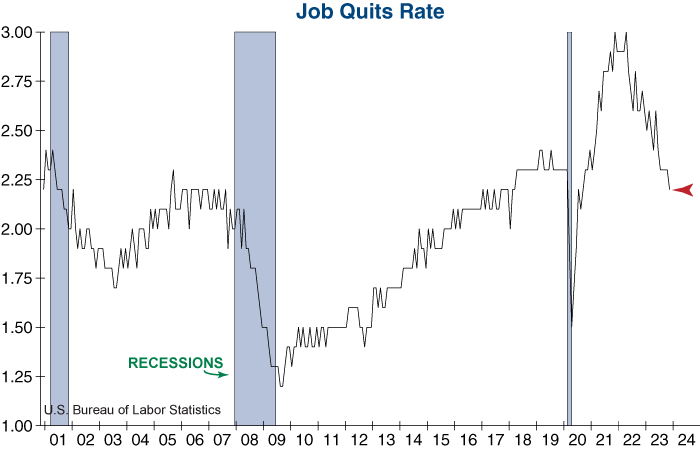

The number of people quitting their jobs decreased as well, resulting in a drop in the Job Quits Rate (graph below). If hires and quits continue to fall rapidly, it could mean bad news for the labor market.

Also released today were minutes from the December FOMC meeting. While this meeting, and the possibility of interest rate cuts in 2024, helped fuel the exuberant year-end rally, the majority of FOMC members continued to expect slower growth for Q4 and believe the lagged effects of their monetary policy are yet to be felt. Inflation has been falling as planned, but this improvement has been uneven, with core components remaining sticky while energy and goods prices have fallen. Meeting participants are highly uncertain about the economic outlook and were clear that additional monetary tightening could be required if upside inflation risks appear. Today’s minutes were absorbed by investors as the S&P 500 pulled back from technically overbought levels for its second trading day of the year.