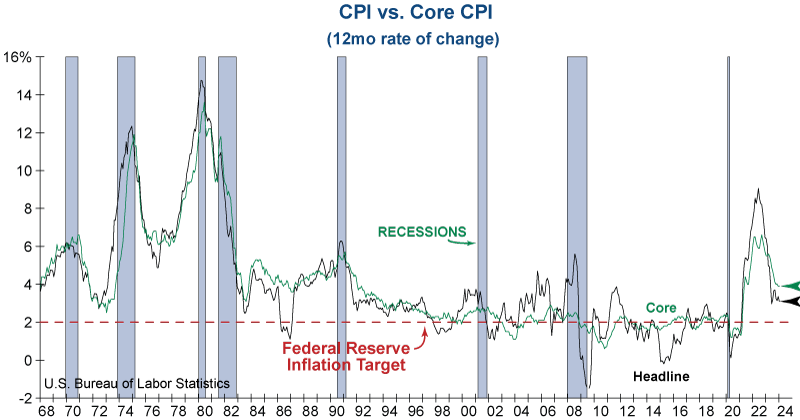

Yesterday’s report for January Consumer Price Index (CPI) came in higher than expected at 3.1% year-over-year, but still lower than the 3.4% year-over-year (YoY) reading for December. Core CPI (excluding food and energy) came in flat at 3.9%, unchanged from the previous month and higher than the 3.7% anticipated. On a month-over-month basis, headline CPI was up 0.3% and core was up 0.4%.

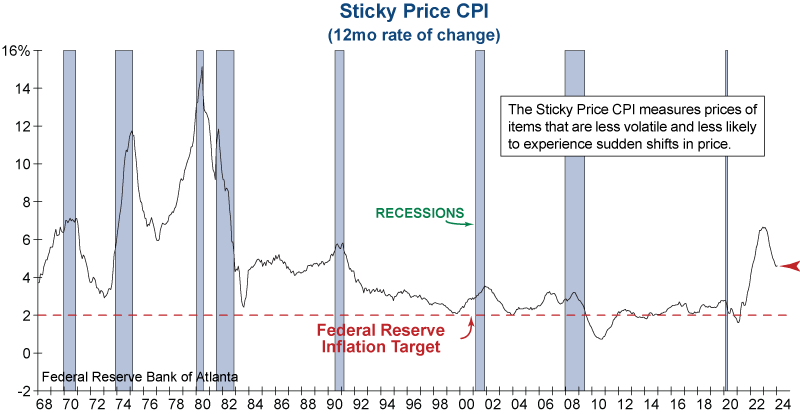

Sticky CPI from the Atlanta Fed, which measures items that change price relatively slowly, was true to its name, holding firm in January at 4.6%.

Despite headline CPI slowing and Core CPI remaining flat YoY, the S&P 500 reacted strongly, closing down 1.4% on Tuesday after breaking through 5,000 just last week. Perhaps the S&P 500 reacted to the slight uptick in “supercore” inflation. This measure is one that the Fed has paid more attention to in recent years as it tracks inflation less goods, energy, and shelter. The Federal Reserve views this as a good representation of embedded wage inflation in the services side of the economy. As of January, it ticked up 0.3 percentage points. Bottom line, this CPI print suggests that markets may have been premature in aggressively pricing in rate cuts for 2024. Investors may be realizing that these cuts are not coming as soon or as frequently as they had hoped and that the last mile down to the Fed’s goal of 2% inflation will take much longer than expected.