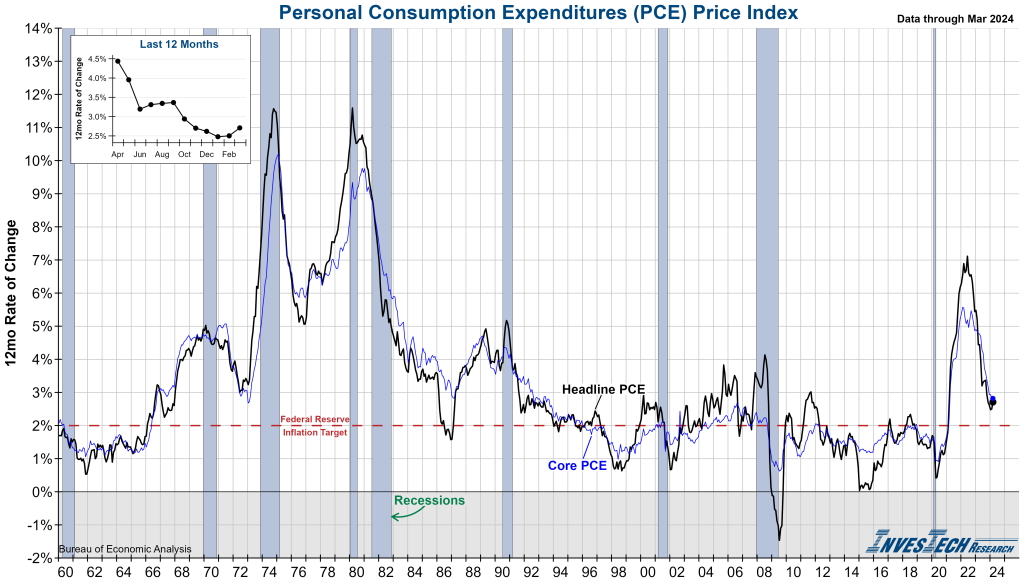

The Federal Reserve is stuck between a rock and a hard place as recent economic data highlights inflationary pressures remain uncomfortably high. Personal Consumption Expenditures (PCE) inflation data for the month of March came in hotter-than-expected this morning. Core PCE held firm at 2.8 % and Headline PCE rose from 2.5% to 2.7%.

This confirms the uptick in the Consumer Price Index (CPI) released earlier this month (see Market Insight), and reiterates that the Fed’s battle is far from over. The recent trend is especially problematic for the FOMC as Core PCE has moved up to an annualized rate of 4.4% over the last 3 months.

Consumers are increasingly reflecting their concerns regarding the reacceleration of inflation. Consumer Sentiment from the University of Michigan was below consensus and slightly down from last month. Both Current Conditions and Future Expectations took a drop with Future Expectations falling from 77.4 to 76.0 and Current Conditions dropping from 82.5 to 79.0.

However, more importantly, both near-term and longer-term inflation expectations saw a notable increase. Near-term inflation expectations were above forecast and up to 3.2% from 2.9% last month. Five-year inflation expectations were in line with consensus and up from last month at 3%.

Inflation is proving to be stubborn and falling much more slowly than the Fed would like, lowering the probability of interest rate relief in the near-term. Investors who were entrenched in rate cut hopes could be in for a surprise.