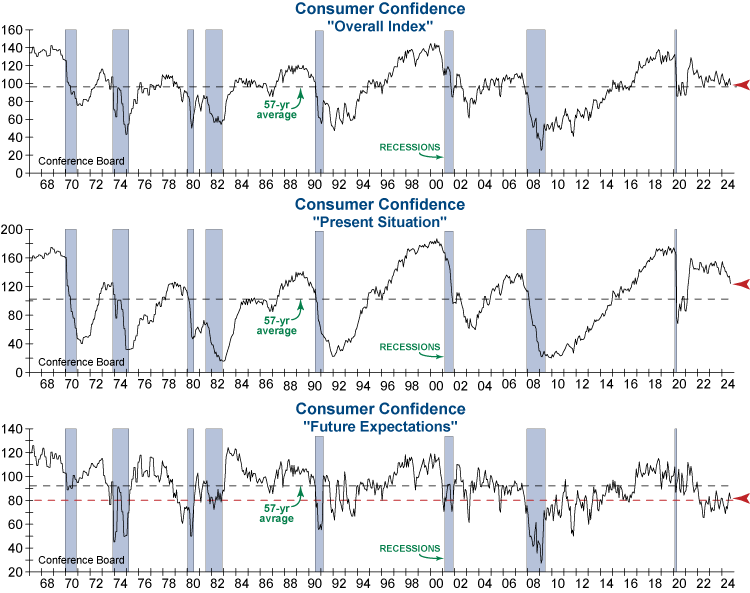

Consumer Confidence dropped 6.5% in September as consumers become increasingly worried about the outlook for the U.S. economy. This dramatic downside surprise was the largest monthly drop since August 2021, with a decline in all five subcomponents. That includes both current and future business conditions, personal income, and current/future labor outlook.

The Present Situation Index fell by 10.3 points, as consumers’ assessments of current conditions turned decisively negative. This is its lowest reading since March 2021. The Expectations Index also fell to 81.7, remaining only slightly above 80, which is the signal threshold for a recession ahead. In addition, 12-month inflation expectations ticked upward to 5.2%.

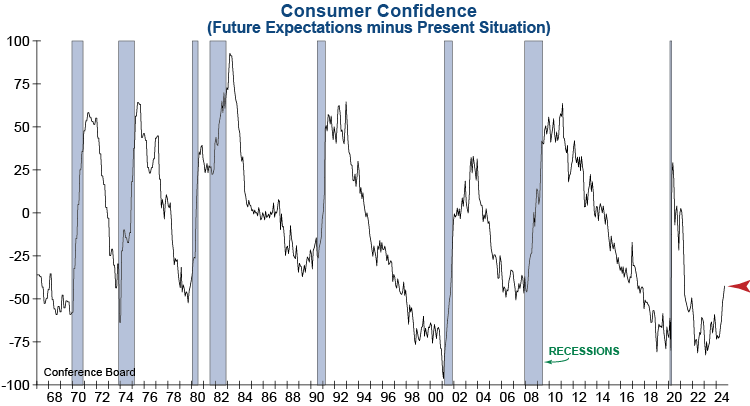

As a result of this month’s dramatic decline in the Present Situation Index, the Future minus Present measure has jumped again. When we have seen this kind of sustained, rapid increase, it almost always means trouble ahead…

Last week’s September issue of InvesTech Research emphasized that for an economic soft landing to be successful, consumers have to believe it to be true and have the confidence to increase spending. This report shows that’s not the case! Individuals are still feeling inflationary pressures, despite the decline in headline CPI over recent months, and their worries about the labor market are increasing significantly. This is a major recession warning flag and another reason we continue to advise a defensively allocated portfolio with a focus on economically resilient sectors.