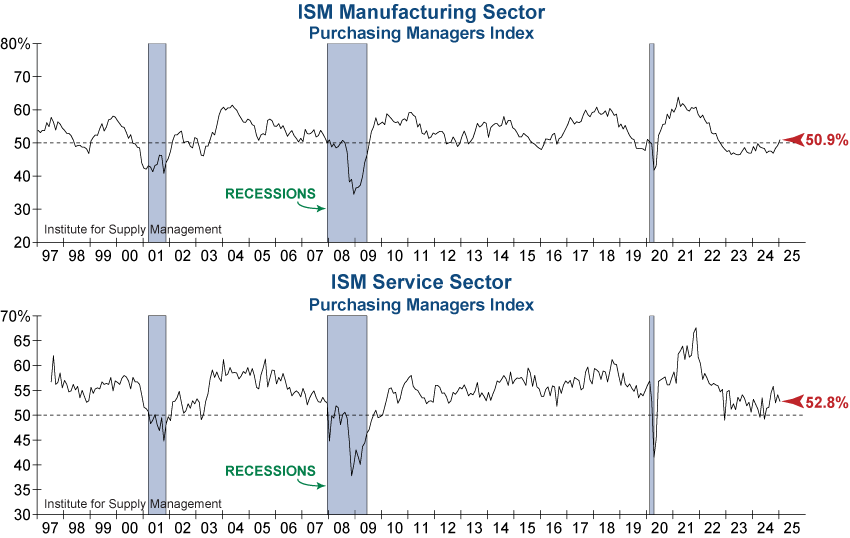

The Institute for Supply Management (ISM) released both their Manufacturing and Services Purchasing Managers Indexes (PMI) for January this week, revealing a cloudy economic landscape with reasons for optimism and looming uncertainties. The Manufacturing PMI (top graph below) was better than expected and finally moved back into expansion (> 50.0%) for the first time since October 2022. Meanwhile, the ISM Services PMI (bottom graph below) unexpectedly fell 1.2 percentage points in January. After giving back much of last year’s bounce, the Services PMI is currently just 2.8 percentage points above the contraction threshold (50.0%).

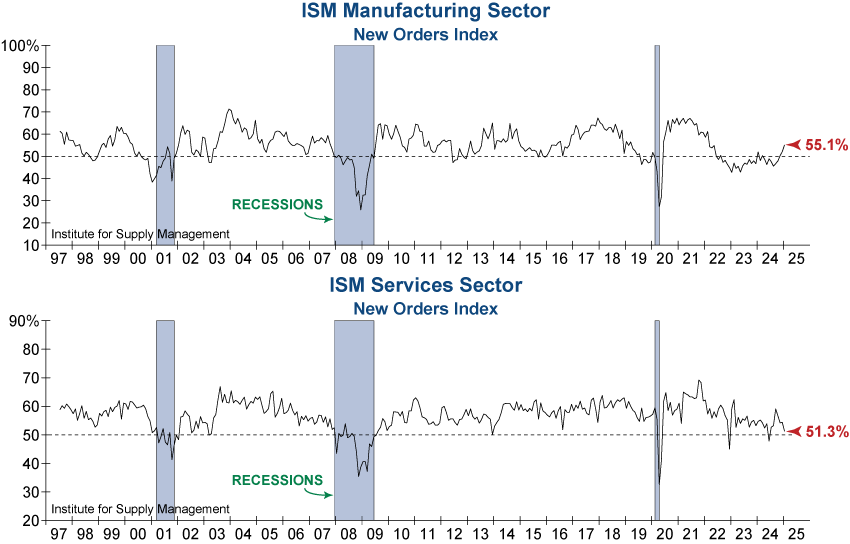

The ISM Manufacturing New Orders Index (top graph below), a leading subcomponent of the overall Manufacturing PMI, saw a notable improvement. This was in stark contrast to the ISM Services New Orders Index (bottom graph below), which fell sharply by 3.1 percentage points. It’s worth noting that the jump in Manufacturing New Orders may be distorted due to front-loaded orders as suppliers attempt to mitigate the risk of looming tariffs. We may see New Orders fall back into contraction over the next few months if this is the case. Overall, these developments are concerning, as the improvements in manufacturing may just be temporary and the services sector accounts for over two-thirds of the economy.

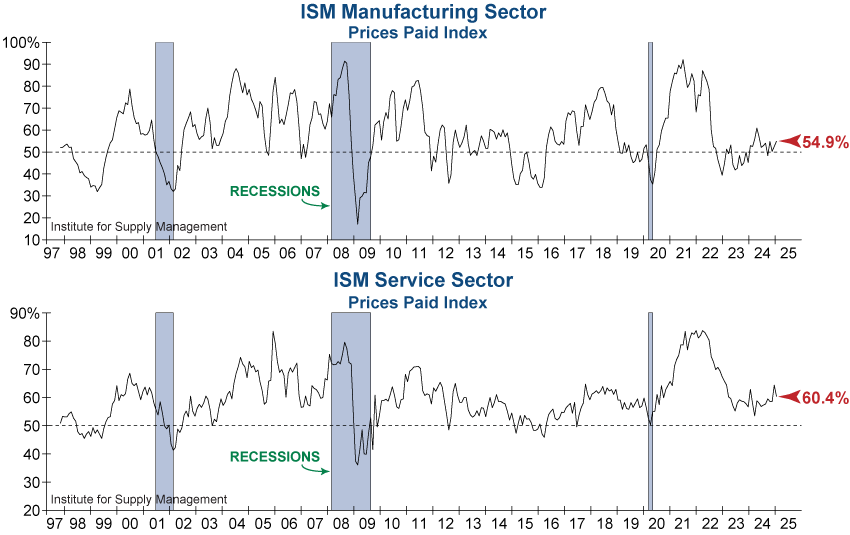

The ISM Manufacturing Prices Paid Index (top graph below) also jumped in January to 54.9%. This is the fourth consecutive month of rising input costs, reigniting inflation concerns. On the services side, the ISM Services Prices Paid Index (bottom graph below) decreased, but is still quite elevated at 60.4%.

Both reports, while seemingly moving opposite one another, share common concerns surrounding tariffs:

“Concern going forward is the cost of materials and project work, if any tariffs go into effect.” [Real Estate, Rental & Leasing]

“The threat of tariffs is causing prices to rise. The threat of unstable international markets is resulting in shortages for various materials.” [Professional, Scientific & Technical Services]

“As the U.S. administration transfers, we will continue to monitor impact of tariffs on materials used for manufacturing. China stimulus is helping us win orders and increase use of services and consumables. Cost pressures remain for all materials and parts but are starting to stabilize.” [Computer & Electronic Products]

After more than two years, this week’s report showed some optimism for the beleaguered manufacturing economy. Yet, the larger and all-important services sector could be signaling a slowdown that would be a shot across the bow of this economy.

For now, the services and manufacturing sectors are sending only one clear message: “Wait and see.” We will continue to closely monitor these essential components of the economy for signs as to how they will react to the quickly changing policy environment.