Bad Leadership => Bad Consequences?

Both the S&P 500 and Nasdaq Composite have had some seriously unusual negative divergences in breadth and leadership over the past few months as detailed in our most recent issue of InvesTech Research.

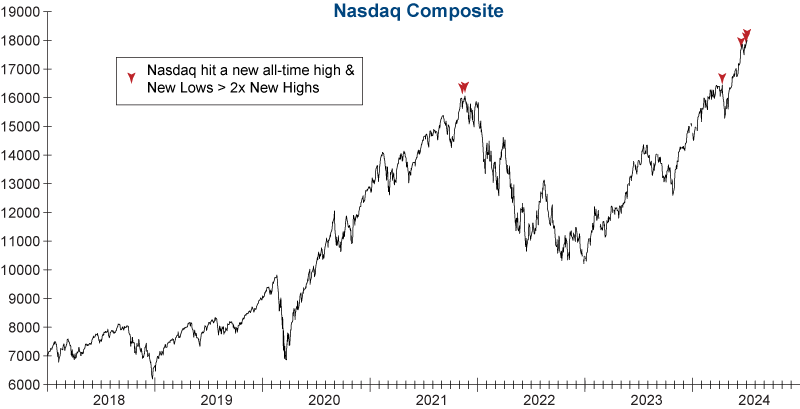

Another “first ever” has occurred in the last couple of weeks… not once but three times! For the first time in the 52-year history of the Nasdaq we saw the number of stocks hitting new 52-week lows outnumber those hitting new 52-week highs by 3-to-1 on the same day that the Index hit a new all-time high on June 14th, 2024. Then it happened again yesterday, July 1st, and again today!

Opening up the search criteria, we looked at when lows outnumbered highs 2-to-1 on days when the Nasdaq hit a new high. With the expanded criteria we pulled in 3 additional dates:

- One occurred just over two months ago on April 11, 2024.

- The other two occurred in November 2021 on back-to-back days that marked the peak in the Nasdaq Composite and preceded a -36% bear market loss.

The last time the Nasdaq Composite saw a leadership divergence of this nature two days in a row, the Index did not hit a new high again for over two years.

Severe leadership divergences do not cause a bear market on their own, but they can be a bear market warning flag that highlights unsustainable conditions and show a technical breakdown in bull market strength.

And, at the very least, this raises the question whether fireworks just might lie ahead.