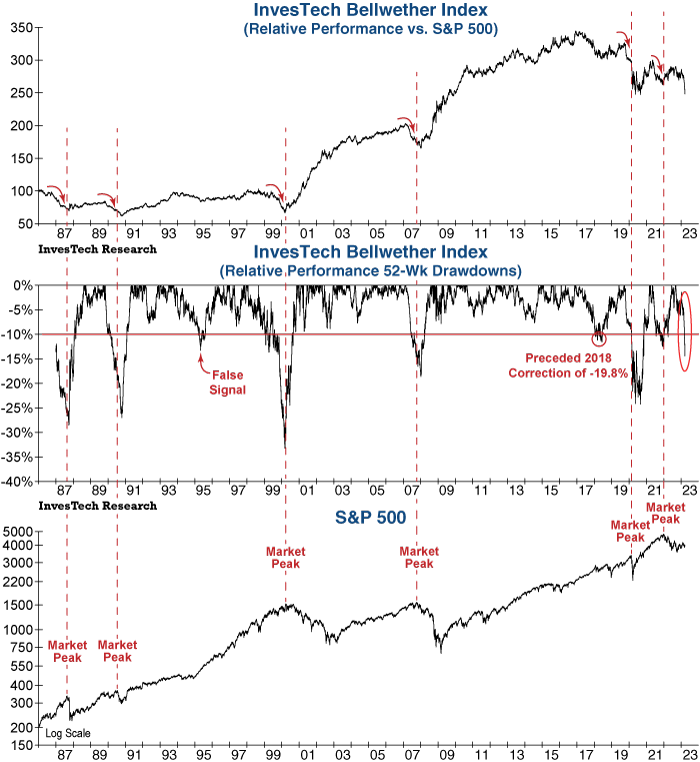

Our Bellwether Index has long been an important tool for gauging stock market risk. When the Bellwether Index negatively diverges from the broader market, it signals that critical areas such as the consumer, the financial system, and/or monetary conditions are under stress. Currently, this key technical tool has just triggered a warning flag in a potentially ominous sign for equities.

Divergences in the Bellwether Index can be quantified by tracking its performance relative to the S&P 500. Specifically, when the Bellwether Index has underperformed the S&P 500 by at least -10% over a 52-week period, it has nearly always preceded an extended selloff in the broader market (middle chart below).

Today, with the continued tightening from the Federal Reserve and recent turmoil in the banking system, the Bellwether Index has just plunged below the critical -10% threshold. This signal is reason for caution and highlights that the stock market could be vulnerable to a selloff in the weeks or months to come.

Eli Petropoulos, CFA – Sr. Market Analyst