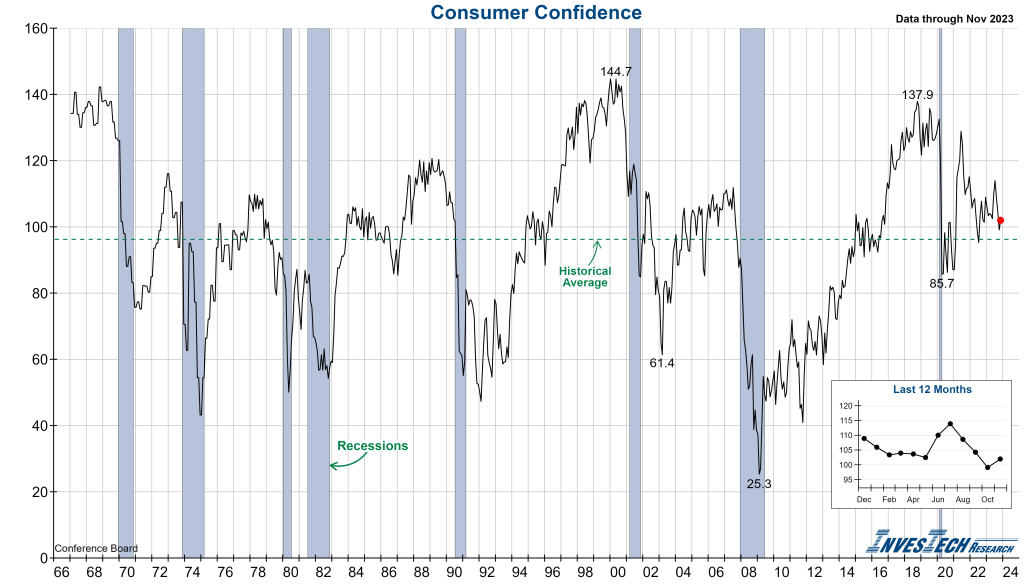

The Conference Board (CB) releases the Consumer Confidence Index on a monthly basis to track how consumers feel about the economy, employment, and spending. The supporting data is based on surveys of about 5,000 different consumers each month and asks questions regarding the current economic conditions as well as their outlook six months ahead.

In addition to the Consumer Confidence Index, the CB also publishes two other Indexes in the same report – the Present Situation Index, which focuses on current conditions, and the Expectations Index, based on near-term outlooks.

This morning’s Consumer Confidence Index for November came in at 102.0, up from a downwardly revised 99.0, slightly better than forecast, and its first improvement in three months. The Present Situation Index declined to 138.2 from 138.6 last month, and the Expectations Index inched up to 77.8 from a downwardly revised 72.7 in October. The Expectations Index remains in the Conference Board’s recession-signal territory (a reading below 80.0) for a third consecutive month.

While the November increase in Consumer Confidence was primarily due to increases in its Expectations Index and rising sentiment in 55 and up households. Confidence declined slightly for households in the 35-54 age cohort and many consumers are still worried about rising prices and high interest rates.

Here’s an excerpt from today’s press release:

“Assessments of the present situation ticked down in November, driven by less optimistic views on current job availability, which outweighed slightly improved views on the state of business conditions. More consumers said that business conditions were ‘good’ compared to last month, but more also said they were ‘bad.’ Regarding the employment situation, more consumers said that jobs were ‘plentiful’ compared to October, but the number saying jobs were ‘hard to get’ also increased. By contrast, when asked to assess their current family financial conditions (a measure not included in calculating the Present Situation Index), the share reporting ‘good’ rose, and those citing ‘bad’ fell, suggesting consumer finances remain healthy heading into the holiday season.”

Interested in reading more? Access a select few publicly available Market Insights here.