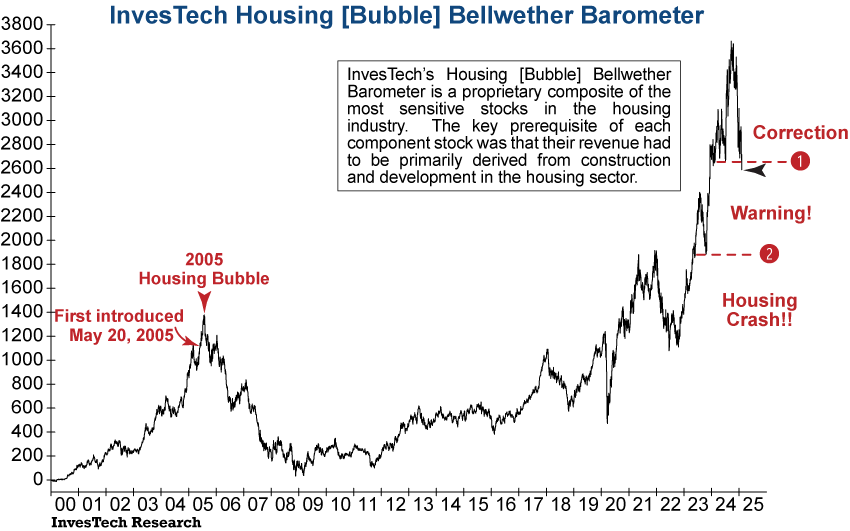

InvesTech’s Housing [Bubble] Bellwether Barometer, which tracks stocks with the greatest sensitivity to the housing market —such as homebuilders and mortgage financing companies— plunged decisively through its first support level today, signaling a serious warning flag for the housing market. The indicator peaked in September and, after hovering just above its first support (1 on graph) for nearly two months, it has plummeted through the cautionary level. It is now -29% off its peak after a -4% drop today. If the Housing [Bubble] Bellwether continues to fall and breaks through its next support level (2 on graph) it would indicate that the housing bubble has begun to unwind, and a crash could be imminent.

The housing sector is critical to both the economy and investor sentiment, and a breakdown could have wide-reaching effects on the broader stock market and overall economy. The Housing [Bubble] Bellwether Barometer gave InvesTech an advance warning of the housing crash in 2005-07 and the Great Financial Crisis that followed, so we know that when it starts to say something, it’s important to listen.