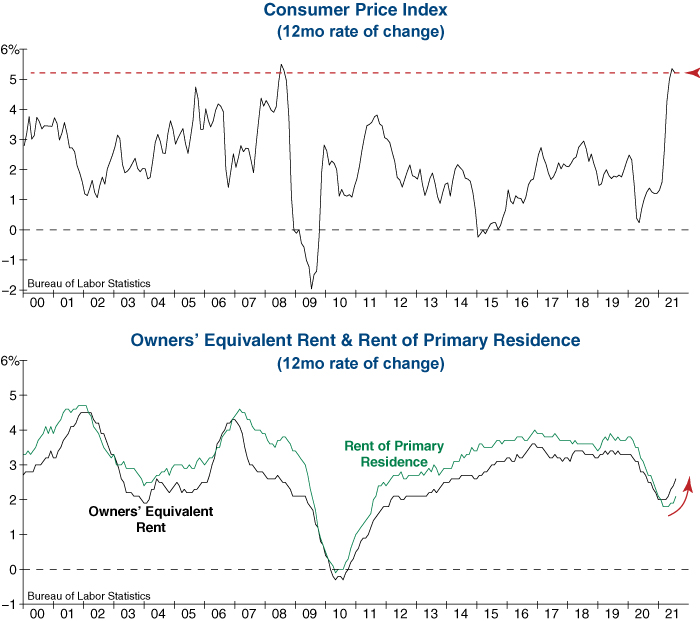

The Consumer Price Index (CPI) remained at one of the highest readings of the past twenty years as it ticked down to 5.3% from 5.4% last month (top graph). While some items which experienced rising prices following the economic reopening have started to normalize, the report showed that inflation is continuing to become broader and stickier. Most notably, the owners’ equivalent rent and rent of primary residence components –housing measures which collectively account for nearly 1/3 of total CPI– continued to climb (bottom graph) and are likely to keep inflation at an elevated level for as long as they maintain an upward trend.