Today’s report for the Institute for Supply Management’s (ISM) Services Purchasing Managers Index (PMI) showed surprisingly strong expansion, but with a troubling increase in inflation pressures. Despite improvements in most components, bond yields jumped higher and stocks sold off, proving that good news can sometimes be bad news…

A deeper look beneath the surface reveals why the situation is not as encouraging as it seems. Many survey respondents cited end-of-year seasonal factors that boosted demand, but the main focus was tied to concerns about potential tariffs. This implies that the services sector could be weaker in the coming months after new policies are introduced.

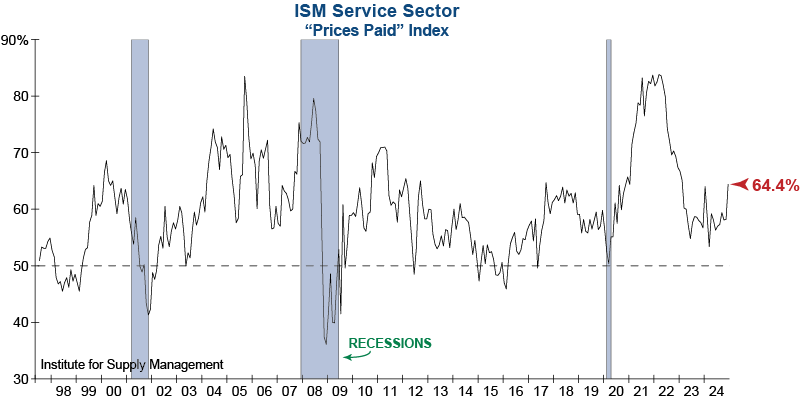

One of the most concerning aspects of the report was the dramatic rise in the Prices Paid subcomponent of the PMI. The Index jumped by a red-hot 6.2 percentage points last month, reaching over 60% for the first time since January 2024. A staggering 83% of industries reported higher prices paid in December, a clear indication that cost pressures are broad-based and becoming more pervasive.

Inflation currently remains above the Federal Reserve’s 2% target and this report shows price pressures may be reaccelerating. This poses significant challenges for both the economy and Fed policy.

Since September, the Fed has implemented several interest rate cuts in an attempt to support economic growth. However, despite these efforts, longer-term bond yields have actually continued to climb. This suggests that investors may be rejecting the idea that inflation has been tamed, which would likely limit the Fed’s ability to reduce rates further in the near term. This puts the Fed between a rock and a hard place to start 2025.