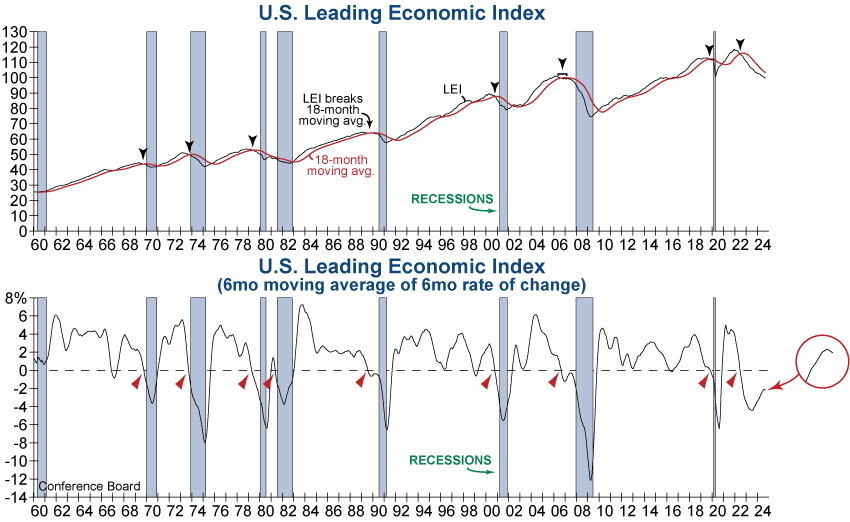

This morning’s Leading Economic Index (LEI) from the Conference Board fell yet again by 0.5% in September, which was substantially worse than expected. Several key factors contributed to this decline, including weak manufacturing new orders, an inverted yield curve, declining building permits, and subdued consumer expectations about future business conditions. While the downtrend in leading economic data has been in place since early 2022, this morning’s report suggests a likely further slowdown in economic activity or potential recession. It’s also notable that current LEI levels are even lower than they were during the height of economic shutdowns and uncertainty during the pandemic.

The LEI has now fallen by 2.6% over the past six months, and with September’s disappointing results and multiple negative revisions to prior months’ data, our 6-month moving average of the 6-month rate of change has rolled back over (bottom graph above). Historically, a sustained decline in this measure is often seen as a strong signal of an impending recession. There have been just two times when this measure has turned upward while below zero, then downward once again. These were in 1989 preceding the recession that began in mid-1990 and in 2007 prior to the Great Financial Crisis. Additionally, the September decline has triggered the Conference Board’s own six-month recession signal, which is often seen as a clear warning of economic trouble ahead.

Economic uncertainty remains high, driven by weak manufacturing activity, still-elevated interest rates, and cautious consumer sentiment. The sustained decline in leading economic data suggests heightened risk of recession, and whether this negative trend continues or reverses in the coming months will be critical in determining the broader economic outlook.