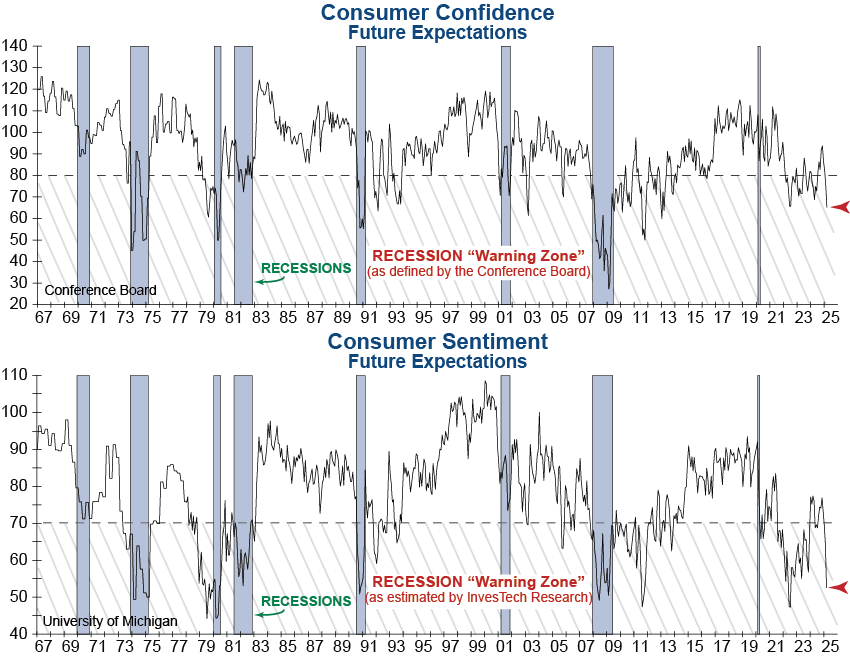

Earlier this week, Consumer Confidence from the Conference Board revealed a dramatic deterioration in consumer attitudes across the board. After remaining in a relatively narrow range for the past few years, Consumer Confidence broke decisively to the downside in this latest reading. Most concerningly, the leading Future Expectations component fell 9.6 points to 65.2, the lowest reading since 2013! This is well below the Conference Board’s “Recession Warning Level” of 80 (dashed line).

This plunge in confidence was confirmed this morning by the latest March release of Consumer Sentiment. The Overall Index fell 12% from its February reading. And following the trend of Consumer Confidence, the leading Future Expectations fell even further, plunging 18% from February. This rapid crumbling of Consumer attitudes was consistent across all income groups and political parties.

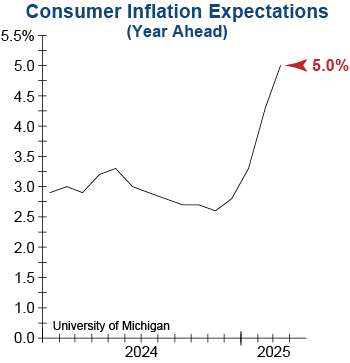

A leading reason for the sharp reversal in consumer psychology is a concern over a reheating of inflationary pressures. In fact, the Consumer Sentiment Inflation Expectations for the year ahead jumped from 4.3% to 5%, logging a third month of large increases of 0.5 percentage points or more.

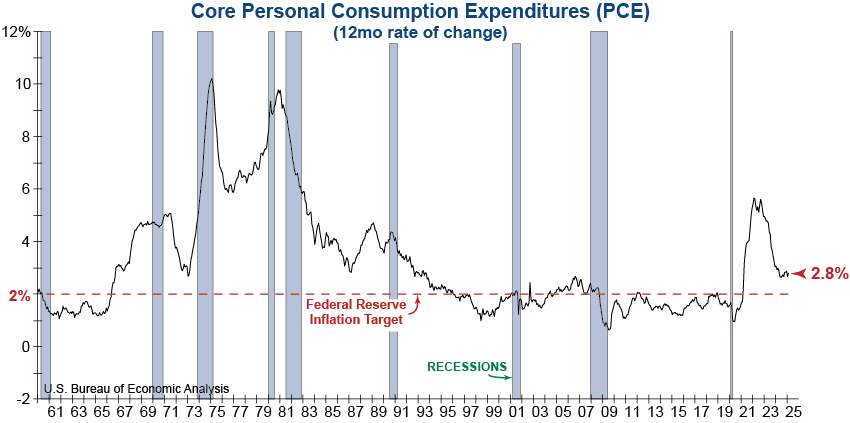

These fears were validated this morning as the Fed’s preferred inflation measure came in well above expectations. The Core Personal Consumption Expenditures (PCE) Price Index rose to 2.8% following an upwardly revised reading last month. This remains stubbornly above the Fed’s 2% target.

This reaccelerating inflation complicates the Fed’s ongoing battle and increases the potential for dismal consumer attitudes to become a self-fulfilling prophecy, a problematic sign for Wall Street and the broader economy.