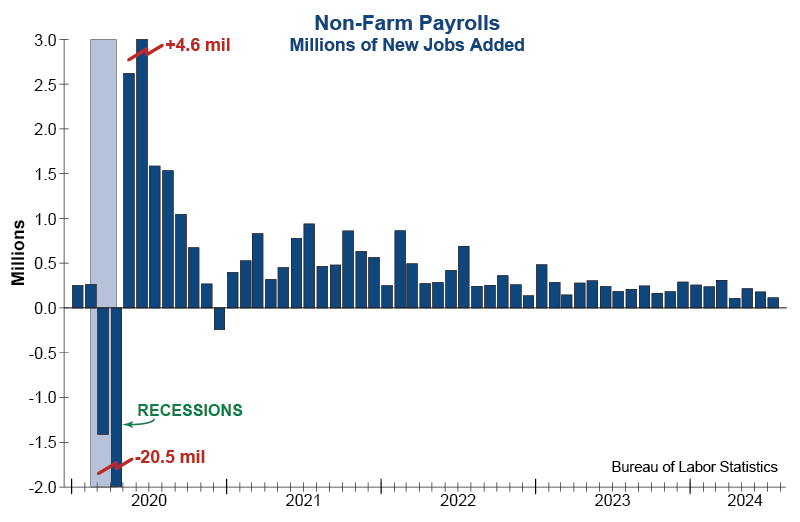

This morning’s Employment Situation report for July from the Bureau of Labor Statistics disappointed forecasts, with just 114K new jobs, which is fewer than the downwardly revised 179K the previous month. As shown in the chart below, this is the second lowest jobs print since December of 2020 and highlights a significant deterioration over the course of the last couple of months. Furthermore, in the last twelve months, almost 70% of job gains have been in the non-cyclical sectors of health care and government.

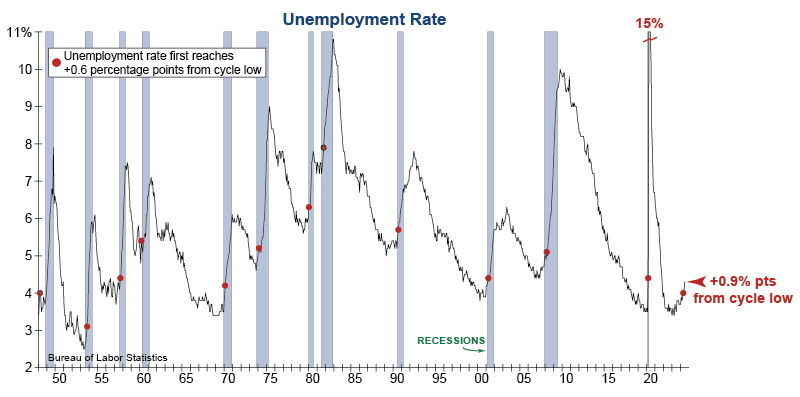

In addition, the unemployment rate rose significantly from 4.1% to 4.3%, its highest since October 2021 (see graph below). The 3-month moving average of the unemployment rate has risen over 0.5 percentage points from its 12-month low, which has triggered the Sahm Rule. This well-known economic indicator has almost always been accompanied by a recession. Our own InvesTech rule of a 0.6 percentage point increase in the unemployment rate from its cyclical low was triggered in June. Similar to the Sahm Rule, our indicator has also confirmed each of the last 12 recessions (red dots on graph).

This morning’s Employment Report shows additional evidence of a dramatically cooling labor market. And while Fed Chair Jerome Powell might claim this is a “normalization” or “rebalancing” of the labor market, historical evidence points to a much more ominous conclusion.

There is no doubt this economy is coming in for a landing, and today’s report provides increasing confirmation that the landing will be significantly harder than many anticipate.