The Advance Estimate for Q4 2022 Real GDP came in at 2.9%, down from 3.2% for Q3 but better than consensus. This may seem like a win against recessionary warning flags, but it doesn’t tell the whole story.

While being one of the most important and talked-about economic data points, GDP tends to be a lagging indicator – only telling the recessionary story after the fact or through subsequent revisions. Nevertheless, it’s important to look at its main components: consumer spending, business investment, net exports, and government spending and investment. The largest chunk? Consumer spending – which is 70% of GDP.

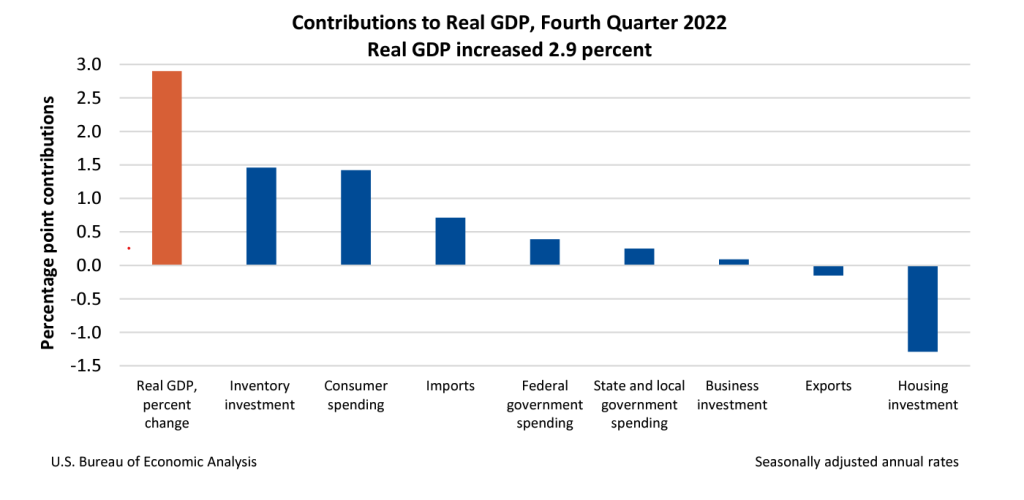

Looking at the latest contributions to Q4 GDP, it’s obvious that almost all growth was in inventory investment and consumer spending. The consumer is still going strong but is shifting from more disposable purchases to necessary-to-live spending. Additionally, consumers still have ample access to credit, using leverage for those much needed purchases. This is looking more and more like recessionary consumer behavior… as long as consumer spending remains high, generally so will GDP. Here’s a short explanation from the BEA of the chart above:

"The increase in private inventory investment was led by manufacturing (mainly petroleum and coal products as well as chemicals) and mining, utilities, and construction industries (led by utilities). The increase in consumer spending reflected an increase in services (led by health care, housing and utilities, and "other" services) and goods (led by motor vehicles and parts). The decrease in housing investment was led by new single-family housing construction and brokers’ commissions."

Jill Mislinski – Research Director & Senior Writer