A slew of economic releases point to a surprising upturn in housing activity. However, as affordability remains a serious concern, we wonder how long this euphoria can last…

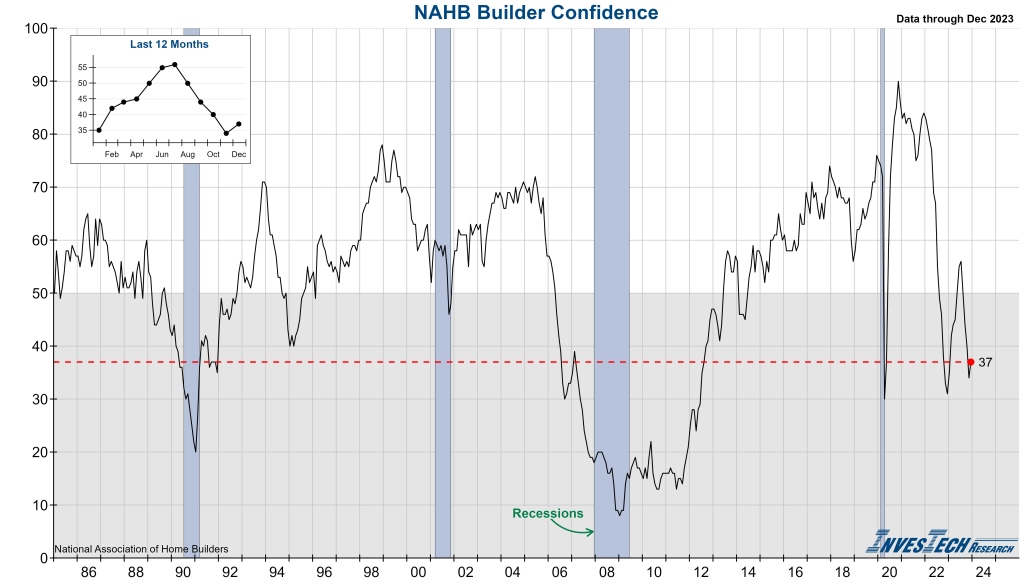

Monday started off with NAHB’s Builder Confidence for December, which came in higher than expected and is up 3 points from its November reading. Falling mortgage rates have helped improve builder sentiment and traffic of prospective buyers alike. Despite the positive inflection this month, both indexes still remain at historically low levels.

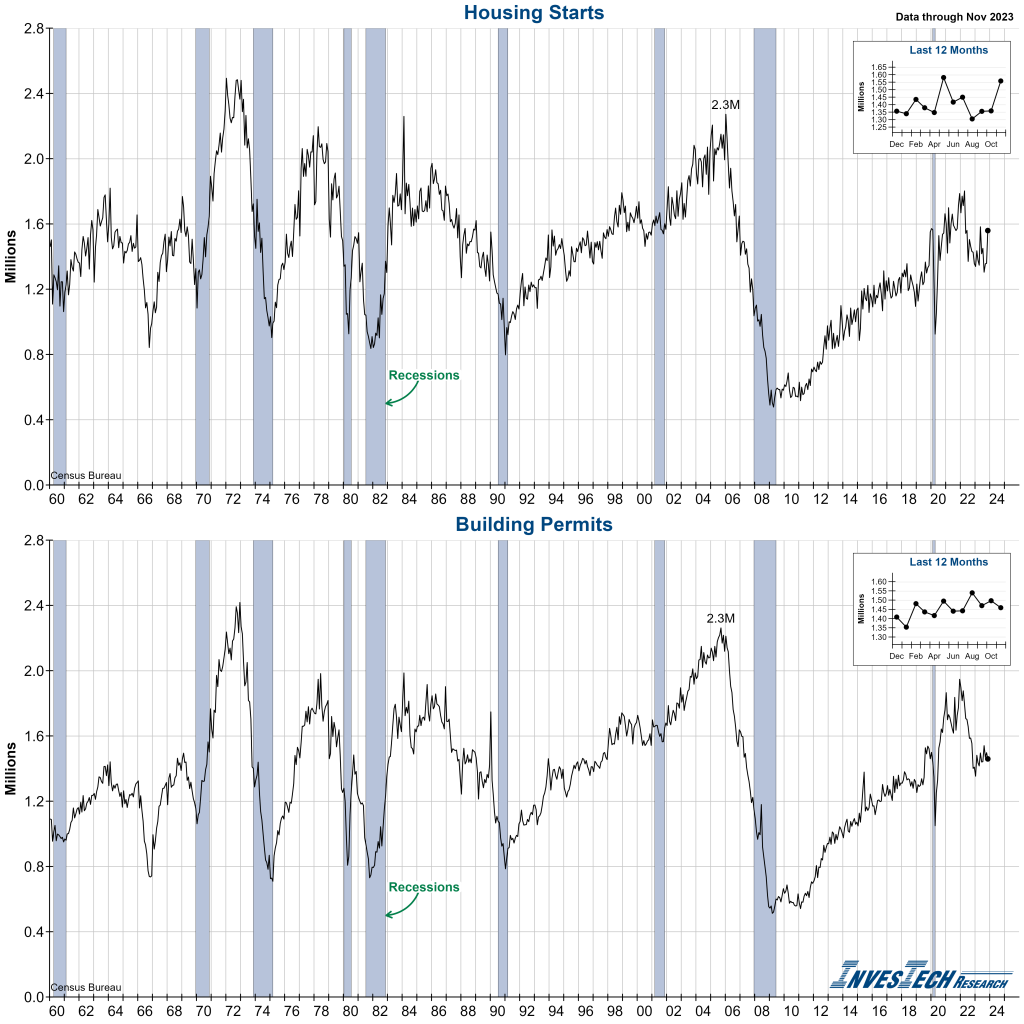

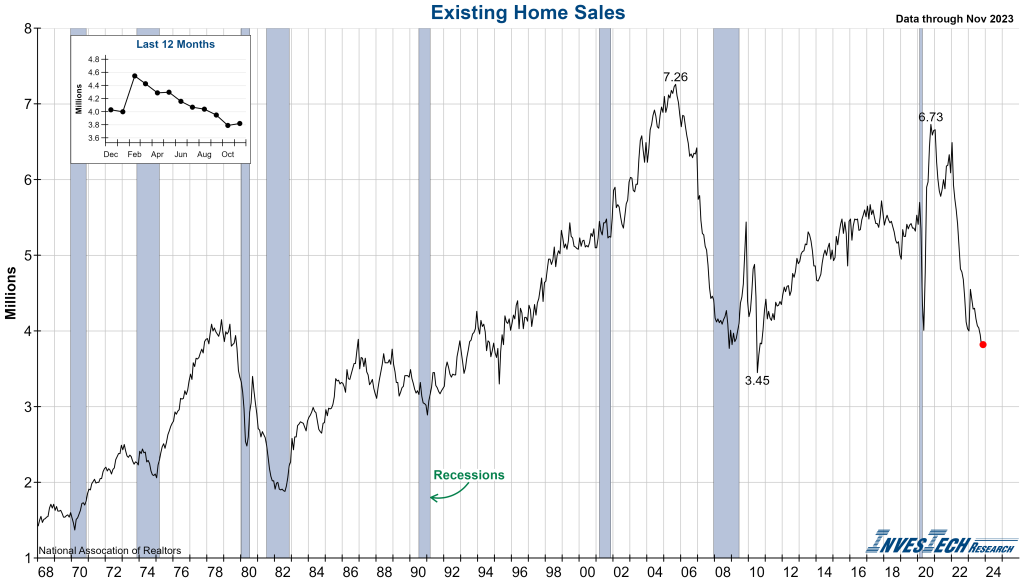

Other housing indicators released this week include Housing Starts and Permits from the Census Bureau and Existing Home Sales from the National Association of Realtors. Housing Starts surprised to the upside with an almost 15% increase from its October value and Permits saw a slight decrease month-over-month (MoM). Existing Home Sales was slightly better than expected for November, with a minor increase MoM. However, sales prices have continued their rise as inventories for existing homes remain extremely depressed.

Both Housing Starts’ and Existing Home Sales’ increases can be attributed to the recent decline in 30-year mortgage rates, which peaked in late October at 7.79% and now stand at 6.95%. While this is a welcome sight for homebuyers it’s important to remember that rates are still at multi-decade highs.

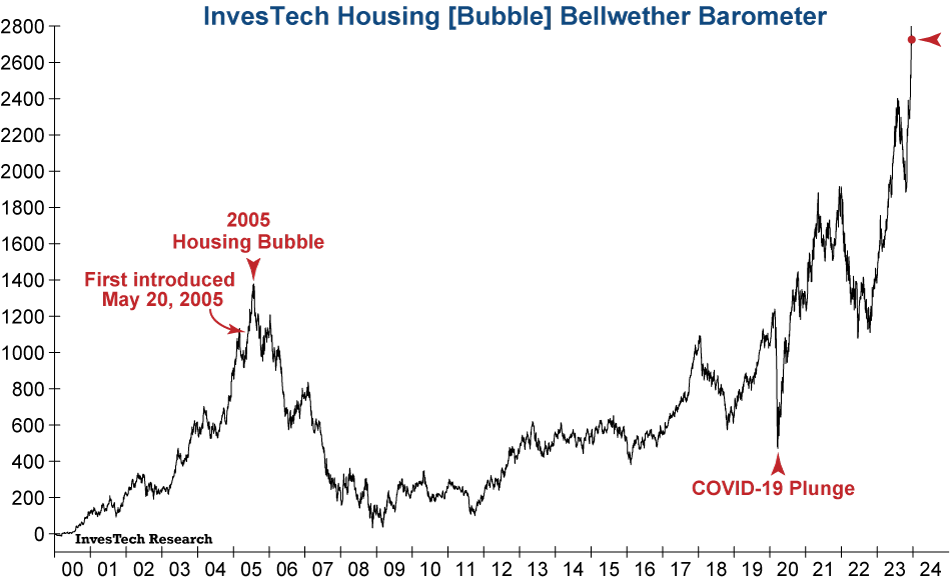

Lastly, our Housing [Bubble] Bellwether Index has recently soared to new highs amid decreasing mortgage rates and anticipation of potential rate cuts by the Fed next year. It has since retreated from that peak but is substantially elevated.

Based on these recent reports, one could conclude that the housing market remains on solid footing. However, rates are still at multi-decade highs and affordability continues to be a headwind. We remain skeptical that the housing market is on track for a much-anticipated soft-landing.